Insurance companies: Premiums on a downward slide

CHANCE TO SAVE Car insurance premiums on the decline. In 2018, premiums were eleven percent lower than in the previous year. The median premium for comprehensive insurance is now 832 francs. This is shown by an analysis of the online portal comparis.ch in a comparison of the development of fully comprehensive premiums for 30- to 40-year-old drivers at the eleven largest car insurers based on ordered [...]

This is shown by an analysis of the online portal comparis.ch in a comparison of the development of comprehensive insurance premiums for 30 to 40-year-old drivers at the eleven largest car insurers based on ordered quote requests. The calculated premiums relate to four different vehicle models.

New competitors active in the market

Comparis mobility expert Andrea Auer: "New players have increased the pressure on established providers. As a result, the variety of offers in Switzerland has increased significantly and prices have started to roll. The price slide for car insurance products in general has only gained momentum in this country in the last five years, in contrast to Germany or the UK, for example. New players have increased the pressure on established providers. As a result, the diversity of offerings in Switzerland has increased significantly and prices have started to roll."

Products from Dextra and Postfinance

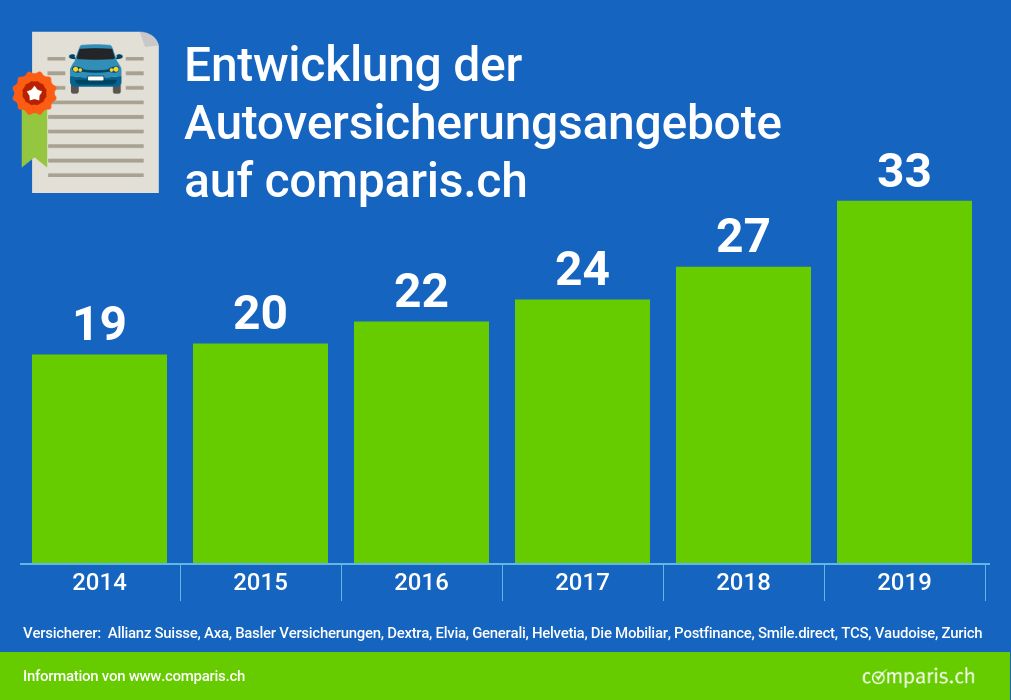

In the last two years alone, online insurers Dextra and Postfinance have made new inroads into the Swiss market with a total of six product variants. The fresh wind also prompted the established providers to expand their product range. Thus, the range of products on the comparis.ch platform has increased from 19 to 33 products in recent years.

Decline will continue

To some extent, the decline in premiums can be explained by the increasing digitization of production processes. Insurers can thus reduce prices without suffering serious margin losses. Andrea Auer: "This development will continue and further ensure falling premiums."

Last notice period in September

However, only car owners who change providers or insist on better conditions for the existing insurance contract will benefit. Cancellation is mandatory in both cases. Andrea Auer: "Policies are automatically renewed without cancellation - and at the old price. Many contracts can be terminated at the end of the year with three months' notice. September is therefore the last time for many car owners to compare offers and, if necessary, cancel their existing insurance."